Paying water tax in Nashik is simple and can be done online or offline. To pay the bill, visit NMC’s website or use their mobile app.

As a Nashik resident, you need to pay this mandatory tax annually to keep your water supply running. The Nashik Municipal Corporation (NMC) collects this money to maintain pipes, pumps, and ensure clean water reaches your home.

You can pay using your index number and consumer number within minutes. If you live in any part of Nashik, such as Cidco, Panchavati, or any other locality, the process remains the same for all residents.

In this guide, you will understand the payment options, steps to pay water tax, current rates, delay charges, and much more, so you can easily pay the water tax without burning time.

Is It Compulsory To Pay Water Tax?

People residing in Nashik have to pay water tax, which applies to every property owner. The Nashik Municipal Corporation (NMC) uses this tax to maintain pipelines and ensure a steady water supply.

It applies to houses, shops, and other buildings, even if they are not in use at the time. If the bill is not paid, NMC may charge a penalty or take legal steps. Non-payment can also lead to water supply disconnection. To avoid extra charges, it is best to pay on time.

Source: Indialaw.in

How To Pay Water Tax In Nashik?

You can pay the Water Bill tax through E-payment via the official Website or Mobile App. You can select any one of the modes that is preferred by you through online payment.

Through Website

Logging through the website is easy; you simply have to search for Nashik Municipal Corporation on the browser and follow the steps below;

Step 1: Go to the official NMC website.

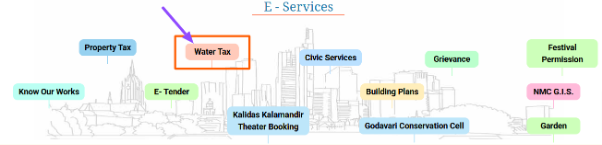

Step 2: Scroll down to the Water Tax Section.

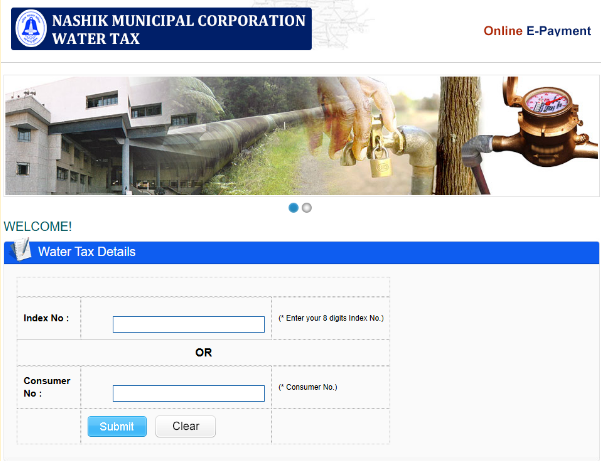

Step 3: Enter your Index no. and consumer number to view and pay tax. Click Submit.

You can download the receipt if you wish to save it.

On Mobile App

If you have the NMC e-Connect mobile app, you can pay your water tax even if you reside outside Nashik.

Step 1: Install the NMC e-Connect app through the Google Play Store on Android.

Step 2: Open the app to pay the water tax.

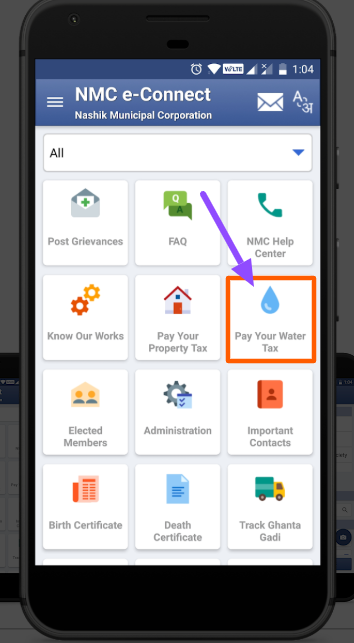

Step 3: Click Pay Your Water Tax.

Step 4: Enter your 8-digit index number and consumer number, then submit to view and pay your bill.

Through Offline Mode

For residents who prefer offline payments, you can visit authorized NMC collection centers located across Nashik. Major banks, such as SBI, HDFC, and ICICI, also accept water tax payments.

Visit the NMC office at Rajiv Gandhi Bhavan, Sharanpur Road, with your water bill and payment. Carry cash or a demand draft along with property documents. Payment receipts are issued immediately for your records.

Set Auto-Reminders And Alerts

To avoid late fees or service blockage, it is a good idea to set a reminder for your water tax payment. You can use the Nashik Municipal Corporation App, Google Calendar, or any phone reminder app to remind you about the due date.

Set the reminder at least 7 days in advance to give yourself enough time. You can also choose a recurring annual reminder so that you do not need to remember it manually every year.

This short step helps ensure timely payment, keeps your water service running smoothly, and protects you from unnecessary punishment.

Water Tax Charges & Calculation in Nashik

The Nashik Municipal Corporation (NMC) applies water tax based on several factors, including property type, residential, commercial or industrial usage, and property location.

Residential properties generally have lower rates, while commercial and industrial properties are charged more. The tax is calculated per 1,000 liters (KL) of water consumed, and additional charges may apply for maintenance. Water tax is billed annually and must be paid within the due date to avoid penalties, as per the NMC.

How to Calculate Your Water Bill?

To calculate your water bill, you need to consider the following factors:

- Consumption (in kiloliters per month).

- Tariff per KL (as per NMC’s slab rate for different usage types).

- Fixed charges for maintenance.

Example Calculation:

A residential property is consuming 20 KL of water per month.

If the rate is ₹10 per KL, then:

20 KL × ₹10 = ₹200 per month

Annual charge = ₹200 × 12 = ₹2,400

Plus maintenance fee (say ₹500 annually)

Total payable water tax = ₹2,900 per year

What If You Delayed To Pay Water Tax In Nashik?

If you fail to pay your water tax in Nashik on time, the Nashik Municipal Corporation (NMC) may impose penalties and take legal action. Late payments result in additional charges, and repeated non-payment could lead to water supply disconnection.

- NMC charges a 2% monthly penalty on overdue water tax payments.

- If dues remain unpaid for an extended period, NMC may disconnect the water supply to the property.

- Legal notices may be sent to property owners with outstanding payments.

- Reconnection of the water supply requires clearing all dues and additional reconnection charges.

- Persistent non-payment may result in legal proceedings by the municipal corporation.

It is advisable to pay water tax on time to avoid inconvenience.

Nashik Payment Water Tax Support

Residents can contact the Nashik Municipal Corporation (NMC) through various support channels with any queries or issues regarding water tax payments in Nashik.

- Helpline Numbers: 0253-2575631 / 2 / 3 / 4

- Email Support: Contact NMC at info@nmc.gov.in for assistance.

- Office Address: Rajiv Gandhi Bhavan, Sharanpur Road, Nashik – Visit in person for offline support.

Also, check out the property tax guide for Nashik residents to learn how to Pay NMC property tax online easily and avoid penalties.

NMC provides customer service to help with billing issues, disconnections, tax calculations, and other concerns related to water tax payments.

More Suggested Reads:

Conclusion: You can Pay water tax in Nashik Through Both Online and offline Modes

Paying your water tax on time in Nashik is essential to avoid penalties and water disconnection. With online payment through the NMC website and mobile app, the process has become much easier for residents.

You can also visit authorized centers for offline payments. Remember to set reminders for timely payments and keep your receipts safe.

If you face any issues, the NMC customer service is available to assist you by phone, email, or in person. As a responsible Nashik citizen, pay water tax on time for a regular supply of water and to avoid the late charges. By doing so, you are supporting the development of Nashik’s water infrastructure.

FAQs

You can check your NMC water bill online by visiting the Nashik Municipal Corporation website. Enter your property details or consumer number to view the bill.

To pay your water tax online, visit the NMC website, go to the water tax section, enter your details, and complete the payment using net banking, UPI, or debit/credit cards.

After making the payment online, you can download the water bill receipt from the NMC portal under the payment history section. Keep it for future reference.

Log in to the Nashik Municipal Corporation website, navigate to the payment history section, enter your details, and view past water tax payments and receipts.

You can find a detailed guide on paying water tax in Nashik in PDF format on the NMC website under the water tax section for step-by-step instructions.